|

gibson capital

Navigate Life’s Financial Peaks

Achieve lasting financial security with strategies that balance cutting-edge technology and timeless expertise.

|

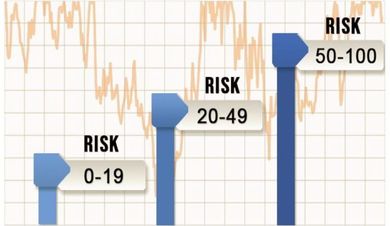

Find Your Personal Risk Score

Most people have no idea what their true appetite for “risk” is when it comes to growing wealth for retirement. We use the industry’s most accurate risk assessment software to help clients determine their personal Risk Score. If you want to know your Risk Score on a scale from 1-100, click on the button below.

Do you wonder how risky your investments are?

Find out by using our Investment Risk Quick Score App!

At Gibson Capital, we help individuals and families secure lasting financial success through personalized wealth management, retirement income planning, and legacy creation. Our innovative strategies ensure your financial journey is guided by wisdom, technology, and care.

|

What We Do for you

Crafting a Financial Future as Unique as Your Life's Journey

3-Dimensional Investing

Go beyond traditional investments with active, data-driven strategies that diversify your portfolio and can lower risk in various market conditions.

Private Pensions

We are living longer. To hedge against longevity risk, we provide guaranteed income that lasts in perpetuity for as long as you live.

Safe Money Strategies

Protect your wealth and lock in gains with customized strategies that eliminate market risk and provide steady, reliable growth.

Tax-Efficient Strategies

Optimize your wealth with smart tax strategies that reduce your taxable income, defer taxes, and maximize after-tax growth.

Long-Term Care Solutions

Plan ahead to cover long-term care costs with innovative solutions that safeguard your savings and ease the financial burden on your family.

AI Investing

AI-driven strategies analyze vast market data, adapt to changing conditions, and offer machine learning and deep learning insights to help enhance risk adjusted returns.

About us

Meet Steve, CAS

CEO

“I believe life’s financial answers can be found in nature’s balance — where resilience, growth, and stability work together.”

- Founder’s Legacy: Inspired by his late father’s financial expertise, Steve continues a family tradition of personalized, values-driven advising.

- Holistic Approach: With over a decade of experience with investing, retirement planning, and insurance, Steve offers unparalleled financial insight with a personal touch.

What Makes Us Different

Future-Focused Planning with Gibson Capital

We combine cutting-edge technology and innovative tools—including AI and quantitative driven investing, personalized client portals, advanced income planning and stress test software—to create forward-thinking strategies that empower our clients to secure their financial legacy.

Personalized Guidance

Financial advising that adapts to your evolving needs.

Expert-Led Insight

Backed by over a decade of experience and a commitment to lifelong learning.

Meaningful Relationships

We partner with clients, ensuring every strategy reflects personal goals and dreams.

Forward-Thinking Wealth Management

We stay on the forefront of innovation and technology to create a more efficient and seamless approach to managing your financial future.

|

Education & Insights

Stay Informed, Stay Empowered

Weekly Insights Newsletter

Wisdom of Wealth

Get expert financial tips, market updates, and tech-driven insights.

-

5 Myths About Fixed Indexed Annuities

07-30-2025 -

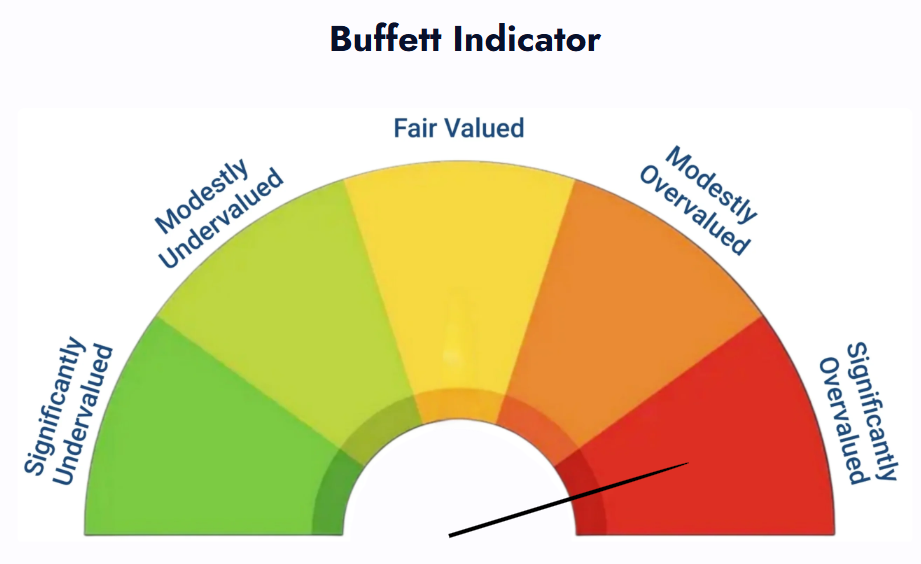

Understanding the Buffett Indicator: What It Tells Us About the Stock Market Today

07-22-2025 -

Growing Your Wealth Like a Redwood Tree

07-19-2025 -

How You Leave Your Money Matters: Don’t Let Taxes Eat Up Your Legacy

07-15-2025 -

Always Invert: The Problem-Solving Trick To Investing

07-02-2025 -

How Do Tariffs Work?

06-24-2025 -

Steel and Aluminum Tariffs: Key Points for the Public

06-23-2025 -

What Medical Expenses Can I Deduct From My Taxes?

04-29-2025 -

Why Your Brain Works Against You as an Investor

04-17-2025 -

Hope Is Not a Strategy: The Importance of Tactical Investing in Uncertain Markets

04-04-2025 -

What to Expect in the Job Market: Trends and Advice for Job Seekers

04-02-2025 -

Social Security Employees Sound the Alarm

03-27-2025 -

Unlocking the Tax Benefits of Homeownership

03-27-2025 -

The Future of Fusion Energy: A Revolution on the Horizon

03-12-2025 -

America's Personal Finance Struggle

02-26-2025 -

The 2025 Tariff Shift: What New Trade Policies Mean for You

02-21-2025 -

10 Life-Changing Lessons I Learned from Emmitt Smith

02-19-2025 -

The Buick GNX and Beating the Flashy Competition: A Lesson in Investing

02-17-2025 -

Don't Forget to File Your LLC's Periodic Report

02-14-2025 -

Understanding Life Insurance Trends for 2025

02-11-2025 -

Understanding Risk Tolerance for Smarter Investments

02-06-2025 -

Understanding the Social Security Fairness Act

02-01-2025 -

Money vs. The Economy

01-30-2025 -

Gibson Capital Launches Blueleaf – Your New Financial Dashboard

12-14-2024 -

Why I Usually Don’t Recommend No-Exam Term Life Insurance: Convenience Isn’t Usually Worth the Cost

12-03-2024 -

The Three Functions of Money

11-28-2024 -

Understanding Required Minimum Distributions (RMDs)

11-20-2024 -

The Hidden Risks in Your Trash: Why Shredding Papers Is Essential for Protecting Your Identity

11-15-2024 -

The All-In-One Family Planning Tool: Why Everplans is Essential for EVERY Family

10-24-2024 -

The Hidden Loophole in Retirement Planning for Long-Term Care

10-15-2024 -

Understanding Qualified Charitable Distributions (QCDs)

10-08-2024 -

The Meaning Behind the Eye of Horus

08-29-2024 -

Descending the Retirement Mountain: Why the Climb Down Matters More Than the Ascent

08-15-2024 -

Understanding the VIX: Wall Street’s Fear Gauge and What It Means for You

08-08-2024 -

Hope and Investing: A Journey Beyond Wishful Thinking

07-24-2024 -

Protecting Your Digital Footprint from Scammers: The Rising Threat in the Age of AI

07-19-2024 -

Active Management As An Investment Strategy

07-12-2024 -

2024 Mid-Year Market Update: Navigating an Unstable Economy

07-01-2024 -

Why High Earners Should Consider a Backdoor Roth IRA

06-25-2024 -

The Glorious History of Annuities: From Ancient Egypt to Modern Times

06-19-2024 -

How AI Could Flag Your Tax Return for an Audit: What You Need to Know to Stay Safe

06-07-2024 -

Could Your Tax Bill in Retirement Be TOO BIG?

05-30-2024 -

Understanding Legislative Risk in Retirement Planning

05-22-2024 -

All Roads Lead to Income: How Guaranteed Lifetime Income Can Transform Retirement Security

05-13-2024 -

Quantitative Models Designed To Provide Risk-Adjusted Returns Over a Full Market Cycle

05-11-2024 -

What Peyton Manning Taught Me: Leadership, Preparation, and the Power of Silence

05-10-2024