|

Long Term Care Solutions

Plan Ahead for Peace of Mind

|

What Are Long Term Care Solutions?

Secure Your Future, Relieve the Burden

The cost of long-term care can be one of the greatest financial challenges in retirement. At Gibson Capital, our Long Term Care Solutions ensure you have more resources to cover these expenses while protecting your family from the financial and emotional strain of caregiving.

Understanding the Need for Long-Term Care Planning

do you have a plan?

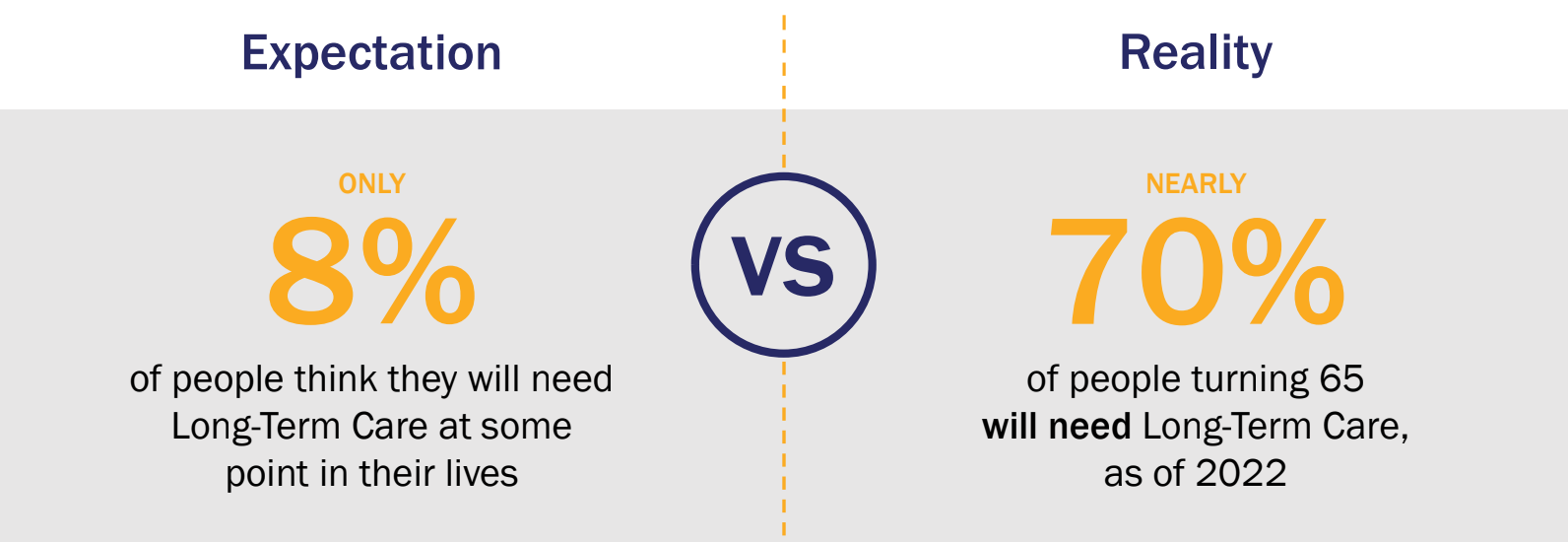

Many people underestimate their likelihood of needing long-term care, which can result in financial strain and unpreparedness. Studies show that while only 8% of people believe they will require long-term care, the reality is that nearly 70% of individuals turning 65 will need some form of long-term care in their lifetime. This significant disconnect highlights the importance of proactive planning.

The Rising Costs of Long-Term Care

Long-term care is not only a reality for many but also a significant financial burden. The current national median annual cost for long-term care services ranges from $51,600 to $105,852 per person, depending on the level of care required. With costs projected to increase by nearly 60% over the next decade, planning today can help safeguard your financial future and ensure you receive the care you need without compromising your savings.

Your Questions, Answered

What are Long Term Care Solutions?

These solutions are strategies and insurance products designed to help cover the costs of long-term care services, such as nursing homes, in-home care, or assisted living.

Why should I plan for long-term care?

Nearly 70% of people turning 65 will need Long-Term Care at some point in their life. In the next 10 years these costs are protected to increase nearly 60%. Without planning, the cost of care can quickly deplete your savings and burden your family.

What types of long-term care planning do you offer?

We provide hybrid life insurance policies with long-term care benefits, annuities with long-term care riders, and annuities with longevity riders that pay monthly in perpetuity.

Are the benefits that I receive taxable?

Many solutions we offer include tax free benefits. But it depends on your health, your specific needs and the type of money. The Pension Protection Act of 2006 (PPA) loophole created substantial tax savings for funding LTC benefits with existing funds in life insurance and annuity cash values.

Can I start planning if I’m already retired?

Yes, it’s never too late to plan. We’ll assess your situation and create a strategy tailored to your current needs.

Prepare for Tomorrow, Today

Learn how our Long Term Care Solutions can protect you and your loved ones. Schedule a consultation now.